Being a solopreneur is exciting—you’re your own boss, you get to call the shots, and you have the freedom to create work you love. But let’s be honest: money management can feel overwhelming when everything depends on you. Unlike a 9-to-5 job, there’s no fixed paycheck, no paid leave, and no HR department handling your taxes.

That’s why learning a few smart money hacks can make life easier, give you more stability, and help you grow your wealth while doing what you love. Here are 10 practical tips that every solopreneur can start using today.

1. Keep Business and Personal Money Separate

Mixing personal spending with business transactions is one of the most common mistakes solopreneurs make. It might seem fine in the beginning, but later it becomes confusing—especially during tax season or when you’re trying to figure out your profit.

👉 Why it matters: It helps you track your business performance clearly and avoid overspending.

👉 Extra Benefit: A business account also makes you look more professional to clients.

💡 Pro Tip: Open a separate business bank account. If you work with international clients, try services like Wise or Payoneer—they save you money on hidden fees and make payments smoother.

2. Automate Your Savings (So You Don’t Forget)

Let’s be real—when income fluctuates, saving often gets pushed to “next month.” That’s where automation saves the day. If you set a rule to move money into savings every time you get paid, you’ll build wealth without even noticing.

👉 Why it matters: Even small amounts, saved consistently, add up over time and give you peace of mind.

👉 Extra Benefit: It keeps you prepared for dry months.

💡 Pro Tip: Start with just 10% of every payment you receive. Use apps like YNAB (You Need a Budget) or Qapital to automatically transfer money into savings or an emergency fund.

Also Read – 15 Best Passive Income Ideas That Work Globally – Build Wealth While You Sleep

3. Pay Yourself a Salary (Yes, Really)

You might think, “Why pay myself when all the money is mine anyway?” But here’s the thing—without discipline, it’s easy to overspend and suddenly have nothing left for business needs. Paying yourself a fixed salary keeps your lifestyle stable and your business running smoothly.

👉 Why it matters: It creates financial discipline and helps you plan your expenses like a pro.

👉 Extra Benefit: Makes your solopreneur gig feel like a real business (because it is).

💡 Pro Tip: Use the 50/30/20 rule—50% on essentials (rent, bills, groceries), 30% on fun (travel, dining out), and 20% on savings and investments.

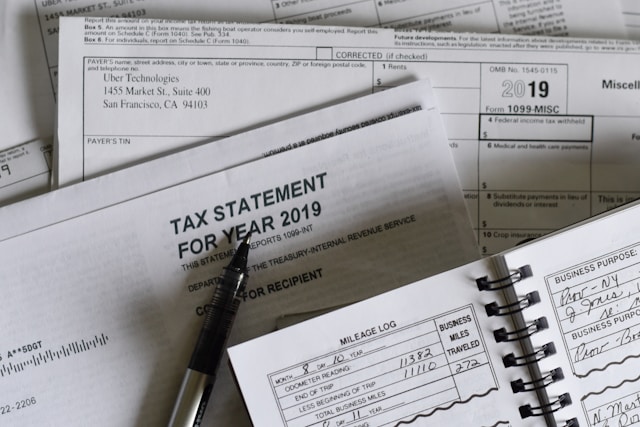

4. Take Advantage of Tax Deductions

Did you know your laptop, internet bills, software subscriptions, co-working space, and even a portion of your rent might be tax-deductible? Many solopreneurs miss out on these benefits simply because they don’t track their expenses properly.

👉 Why it matters: Deductions lower your taxable income, meaning you keep more of your money.

👉 Extra Benefit: You can reinvest those savings back into your business.

💡 Pro Tip: Keep all receipts (yes, even digital ones). Use tools like QuickBooks, Zoho Books, or simply store them in a Google Drive folder. At tax time, you’ll be thankful for the organized records.

5. Don’t Rely on Just One Income Stream

If you depend on one client or one type of work, you’re putting your business at risk. Imagine your biggest client suddenly leaves—what happens then? Having multiple streams of income cushions you from financial shocks.

👉 Why it matters: It gives you financial security and peace of mind.

👉 Extra Benefit: More income streams = more opportunities to grow.

💡 Pro Tip: Start with low-maintenance income streams like ebooks, templates, or online courses. Platforms like Gumroad, Skillshare, or Amazon Kindle Direct Publishing make it super easy to create digital products.

6. Invest in Retirement Early

As a solopreneur, no one is going to build your retirement fund for you. The earlier you start, the more you benefit from compound growth. Even small contributions grow into something big over the years.

👉 Why it matters: Your future self will thank you.

👉 Extra Benefit: Early investments create financial freedom down the road.

💡 Pro Tip: If you’re in the US, look into Solo 401(k) or IRAs. If you’re in India, SIPs (Systematic Investment Plans) are great. Automate contributions so you never “forget.”

7. Use Business-Friendly Credit Cards

A good business credit card isn’t just for payments—it can give you cashback, rewards, travel perks, and even better credit history. Used wisely, it’s like free money for expenses you already have.

👉 Why it matters: You get rewards and build credit for future loans.

👉 Extra Benefit: Keeps your business expenses separate and trackable.

💡 Pro Tip: Choose a card that matches your lifestyle—if you travel a lot, go for a miles card; if you spend more on ads/software, a cashback card is smarter.

8. Cut Unnecessary Subscriptions

It’s easy to sign up for tools, apps, or memberships that you barely use. But those “small” monthly charges add up. Doing a subscription check every few months can save you a surprising amount of money.

👉 Why it matters: You stop wasting money on things you don’t use.

👉 Extra Benefit: Simplifies your workflow—fewer tools, less clutter.

💡 Pro Tip: Use apps like Rocket Money (formerly Truebill) to track subscriptions and cancel the ones you don’t need. Replace costly tools with free ones like Canva, Trello, or Notion.

9. Build an Emergency Fund

As a solopreneur, you don’t get a steady paycheck. That’s why an emergency fund is your safety net. Aim for 3–6 months of living + business expenses. This fund will keep you calm during slow months or if a client pays late.

👉 Why it matters: You won’t panic when income slows down.

👉 Extra Benefit: Gives you confidence to take risks in business.

💡 Pro Tip: Keep your emergency fund in a high-yield savings account where it grows but is still easy to access.

10. Invest in Skills, Not Just Tools

The smartest investment you’ll ever make is in yourself. Tools help, but skills make you money. The more you learn, the more you can charge, and the more opportunities open up.

👉 Why it matters: Skills increase your value in the market.

👉 Extra Benefit: Makes you less dependent on one source of income.

💡 Pro Tip: Dedicate 5–10% of your income to learning. Use platforms like Coursera, Udemy, HubSpot Academy, or even free YouTube tutorials.

Final Thoughts

Being a solopreneur doesn’t mean living with financial uncertainty. With the right money habits, you can create stability, grow your wealth, and enjoy the freedom that comes with working for yourself.

Start small—pick 2–3 of these money hacks today and build from there. Remember, it’s not about how much you earn, it’s about how smartly you manage what you earn.

👉 Your money should work as hard as you do.